Understanding Capital Gains Taxes

The U.S. federal tax system taxes different kinds of income at different rates. Some types of capital gains, such as profits from the sale of a stock that you have held for more than one year, are generally taxed at a more favorable rate than your salary or interest income. However, not all capital gains are treated equally. The tax rate can vary dramatically between short-term and long-term gains. Understanding the capital gains tax rate is an important step for most investors.

What is a capital gain?

Capital gains are profits you make from selling an asset. The most common assets that are frequently sold are investment securities such as stocks and bonds. Other assets include businesses, land, cars, boats. Selling one of these assets can trigger a taxable event. This often requires that the capital gain or loss on that asset be reported to the IRS on your income taxes.

What's the difference between a short-term and long-term capital gain or loss?

Generally, capital gains and losses are handled according to how long you've held a particular asset – known as the holding period. Profits you make from selling assets you’ve held for a year or less are called short-term capital gains. Alternatively, gains from assets you’ve held for longer than a year are known as long-term capital gains. Typically, there are specific rules and different tax rates applied to short-term and long-term capital gains. In general, you will pay less in taxes on long-term capital gains than you will on short-term capital gains. Likewise, capital losses are also typically categorized as short term or long term using the same criteria.

You typically do not benefit from any special tax rate on short-term capital gains. Instead, these profits are usually taxed at the same rate as your ordinary income. This tax rate is based on your income and filing status. Other items to note about short-term capital gains:

If you hold your assets for longer than a year (see exceptions, below), you can often benefit from a reduced tax rate on your profits. Those in the lower tax bracket could pay nothing for their capital gains rate, while high-income taxpayers could save as much as 17% off the ordinary income rate.

What are the exceptions to the capital gains tax rate for long-term gains?

Collectibles: profits from the sale of collectible assets, such as antiques, fine art, coins, or even valuable vintages of wine will be taxed at 28% regardless of how long you have held the item.

Your Primary Residence: If you have owned your home and used it as your main residence for at least two of the last five years prior to selling it, then you can usually exclude up to $250,000 of capital gains on this type of real estate if you're single, and up to $500,000 if you're married and filing jointly.

NIIT: a 3.8% surtax applies to certain net investments above a set threshold. Typically, this surtax applies to those with high incomes who also have a significant amount of capital gains from investment, interest, and dividend income. See our NIIT article by clicking here.

How can I determine my tax rate and how much tax I'll owe?

When selling an investment you need to do the following:

1) Determine the holding period - short or long

What is a capital gain?

Capital gains are profits you make from selling an asset. The most common assets that are frequently sold are investment securities such as stocks and bonds. Other assets include businesses, land, cars, boats. Selling one of these assets can trigger a taxable event. This often requires that the capital gain or loss on that asset be reported to the IRS on your income taxes.

What's the difference between a short-term and long-term capital gain or loss?

Generally, capital gains and losses are handled according to how long you've held a particular asset – known as the holding period. Profits you make from selling assets you’ve held for a year or less are called short-term capital gains. Alternatively, gains from assets you’ve held for longer than a year are known as long-term capital gains. Typically, there are specific rules and different tax rates applied to short-term and long-term capital gains. In general, you will pay less in taxes on long-term capital gains than you will on short-term capital gains. Likewise, capital losses are also typically categorized as short term or long term using the same criteria.

You typically do not benefit from any special tax rate on short-term capital gains. Instead, these profits are usually taxed at the same rate as your ordinary income. This tax rate is based on your income and filing status. Other items to note about short-term capital gains:

- The holding period clock begins ticking from the day after you acquire the asset, up to and including the day you sell it.

- For 2021, ordinary (marginal) tax rates range from 10% to 37%, depending on your income and filing status. See our article on tax brackets.

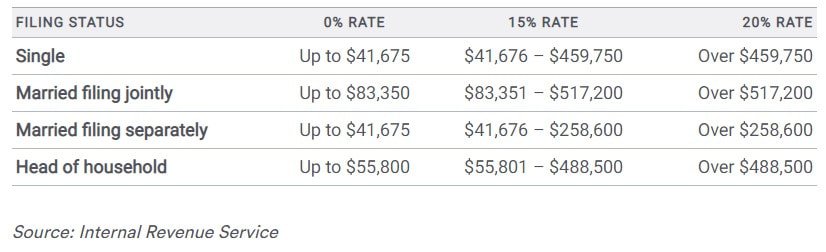

If you hold your assets for longer than a year (see exceptions, below), you can often benefit from a reduced tax rate on your profits. Those in the lower tax bracket could pay nothing for their capital gains rate, while high-income taxpayers could save as much as 17% off the ordinary income rate.

What are the exceptions to the capital gains tax rate for long-term gains?

Collectibles: profits from the sale of collectible assets, such as antiques, fine art, coins, or even valuable vintages of wine will be taxed at 28% regardless of how long you have held the item.

Your Primary Residence: If you have owned your home and used it as your main residence for at least two of the last five years prior to selling it, then you can usually exclude up to $250,000 of capital gains on this type of real estate if you're single, and up to $500,000 if you're married and filing jointly.

NIIT: a 3.8% surtax applies to certain net investments above a set threshold. Typically, this surtax applies to those with high incomes who also have a significant amount of capital gains from investment, interest, and dividend income. See our NIIT article by clicking here.

How can I determine my tax rate and how much tax I'll owe?

When selling an investment you need to do the following:

1) Determine the holding period - short or long

- If you held the investment for less than one year, plan to pay ordinary income tax rates. See our article on tax brackets: www.cwa.tax\tax-brackets

- If you held the investment for more than one year, you need to estimate your MAGI (Modified Adjusted Gross Income). A good starting point is to look at your prior tax return. This figure is on the first page of your Form 1040.

3) Finally, take the total gain on the sale of your investment (the difference between the sales price and purchase price) and multiply it by the applicable tax rate. The result is the tax you can anticipate you'll need to pay on the sale.

Note: The above calculation is designed to give you a conceptual understanding of how capital gains are taxed. There are myriad factors that go into a tax return, and certain events can impact your actual tax rate. So use this as a general guide. Finally, the investment proceeds themselves count toward your MAGI. So you will need to revisit this each time you earn future investment income to ensure you are still within the original tax rate you identified in step 2 (0%, 15% or 20%).

Note: The above calculation is designed to give you a conceptual understanding of how capital gains are taxed. There are myriad factors that go into a tax return, and certain events can impact your actual tax rate. So use this as a general guide. Finally, the investment proceeds themselves count toward your MAGI. So you will need to revisit this each time you earn future investment income to ensure you are still within the original tax rate you identified in step 2 (0%, 15% or 20%).