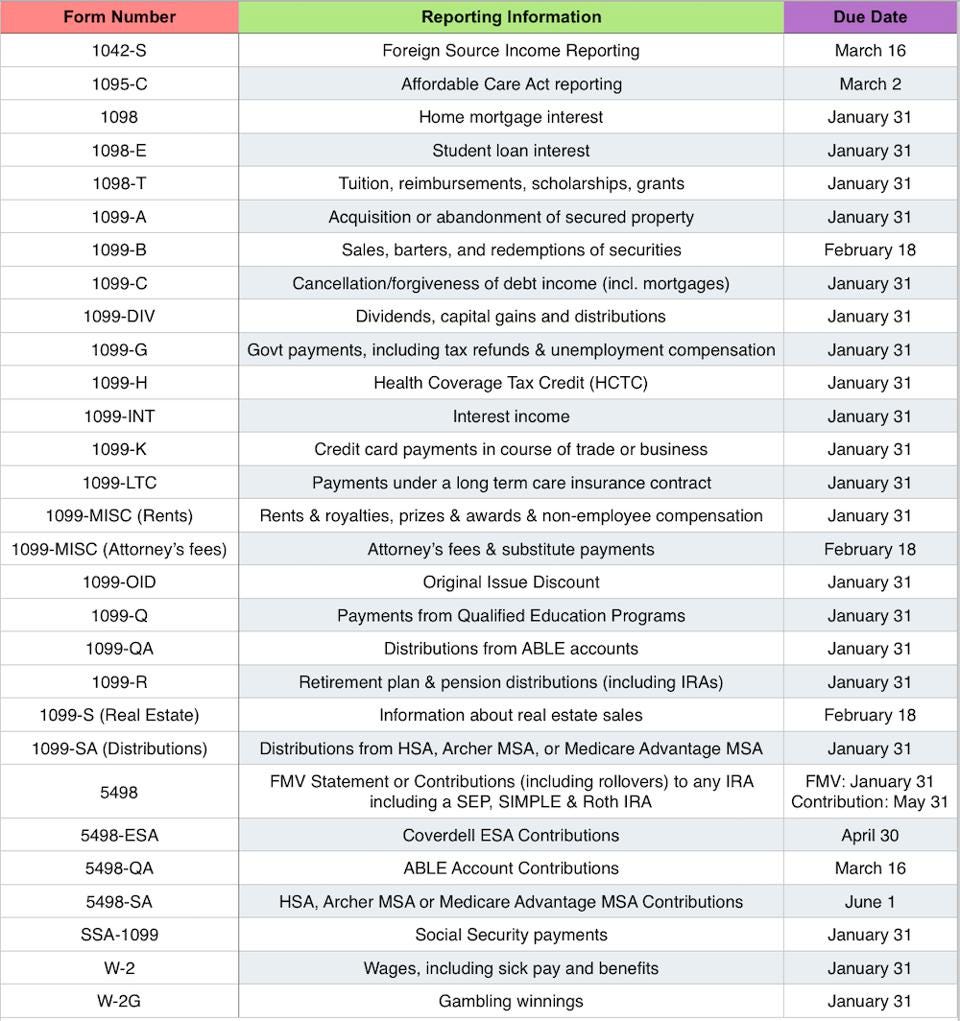

List of IRS Tax Statements and Due Dates |

The IRS has different deadlines for the employers, financial institutions, and others who are responsible for reporting tax information to get your tax documents to you. Below is a chart of IRS due dates* for common tax forms.

* If the normal due date falls on a Saturday, Sunday, or legal holiday, issuers have until the next business day. Dates are subject to change. Also, some providers can request an automatic extension of time.

If you haven't received a tax form by the due date, here's what to do:

If you haven't received a tax form by the due date, here's what to do:

- Look around. Your form could be stuck in a magazine or lost in that pile of mail on the counter that you've been swearing to sort through for weeks. Your form could be at work. Before you assume that it wasn't delivered, double-check.

- Go Online. Many issuers of tax statements now provide the forms online for download. Look for a "Tax Center" or "Documents & Statements" button on your online accounts.

- If you're sure that you didn't receive your forms, contact the issuer. It might be easy to fix. You might not have received the form because of an incomplete or wrong address. Or maybe your form got lost in the mail. If that's the case, the issuer can furnish another form: problem solved.

- If your employer is no longer in business or has moved, try to make contact. It's the fastest, easiest solution. If you don't receive your forms and you don't know where your employer has moved, send a note to the last known address; there may be a forwarding order at the post office. Or try Google. I know that it's not your job to find your employer, but if you have time to click through Baby Yoda memes, you can search online for a change of address.

- If you still don't have your forms, or if your forms aren't correct, contact IRS. The IRS doesn't want to hear from you about missing forms until the end of February. But when you call, have your address, phone number, Social Security Number, and dates of employment available. It's also helpful to have an estimate of your earnings, together with your withholding; you can find most of this information on your last pay stub. You'll also need the name, address, and phone number of your employer. Make your life easier by being prepared before you pick up the phone.

- Be patient. After your call, the IRS will contact your employer. The IRS will also send you a form 4852, Substitute for Form W-2, Wage and Tax Statement, or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., along with instructions. If you don't receive your missing forms from your employer by Tax Day, April 15, file form 4852. But be smart: If you file an improper form, you could be hit with substantial penalties.

- If all else fails. We can file an extension of time for you. Usually tax transcripts are available by late summer, which allows us to get the source information to file your return accurately.