Understanding Net Investment Income Tax (NIIT)

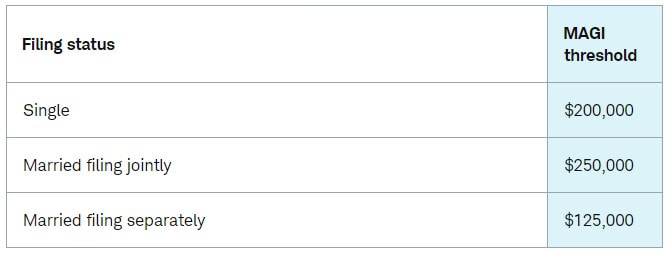

If you make money from the sale of certain investments, you may owe an additional 3.8% surtax called Net Investment Income Tax (NIIT). But you’ll only owe it if you have investment income and your Modified Adjusted Gross Income (MAGI) goes over a certain amount. In this article, we'll explain both terms and provide some examples to help you learn about NIIT.

The first step is to determine if you have investment income:

Net investment income includes the following:

It doesn't include:

The second step is to determine your MAGI:

For purposes of the NIIT, Modified Adjusted Gross Income (MAGI) is generally defined as Adjusted Gross Income (AGI) for regular income tax purposes increased by the foreign earned income exclusion (but also adjusted for certain deductions related to the foreign earned income). For individual taxpayers who haven't excluded any foreign earned income, their MAGI is generally the same as their regular AGI.

The first step is to determine if you have investment income:

Net investment income includes the following:

- Capital gains (short- and long-term)

- Dividends (qualified and nonqualified)

- Taxable interest

- Rental and royalty income

- Passive income from investments you don’t actively participate in

- Business income from trading financial instruments or commodities

- Taxable portion of nonqualified annuity payments

It doesn't include:

- Wages

- Veterans’ or Social Security benefits

- Unemployment pay

- Qualified retirement plan withdrawals (like those from a 401(k) or IRA)

- Payouts from a traditional defined benefit pension plan or retirement plan annuity

- Payouts from a deferred compensation plan from a state, local government, or tax-exempt organization

- Tax-exempt interest from municipal bonds or funds

- Tax-exempt income from the sale of your primary home

- Life insurance proceeds

- Income from a business you actively participate in

The second step is to determine your MAGI:

For purposes of the NIIT, Modified Adjusted Gross Income (MAGI) is generally defined as Adjusted Gross Income (AGI) for regular income tax purposes increased by the foreign earned income exclusion (but also adjusted for certain deductions related to the foreign earned income). For individual taxpayers who haven't excluded any foreign earned income, their MAGI is generally the same as their regular AGI.

How much could you owe?

If you have investment income and go over the MAGI threshold, the 3.8% tax will apply to your net investment income or the portion of your MAGI that goes over the threshold—whichever is less. Let's walk through two examples to explain.

Example 1

Your net investment income is less than your MAGI overage:

Let’s say you have $30,000 in net investment income and your MAGI goes over the threshold by $50,000. You’ll owe the 3.8% tax. But you’ll only owe it on the $30,000 of investment income you have—since it’s less than your MAGI overage.

Your additional tax would be $1,140 (.038 x $30,000)

Example 2

Your MAGI overage is less than your net investment income:

Let’s say you have $30,000 in net investment income, but your MAGI only goes over the threshold by $15,000. Again, you’ll owe the 3.8% tax. But in this case, you’ll owe it on the $15,000 MAGI overage—since it’s less than your net investment income.

Your additional tax would be $570 (.038 x $15,000).