Withholding and Estimated Tax Payments Explained

A client education article for clients of Claeys Wolkens & Associates

The United States federal taxing system is a “pay as you go” system. Following this system, your taxes must be paid to the government in two ways:

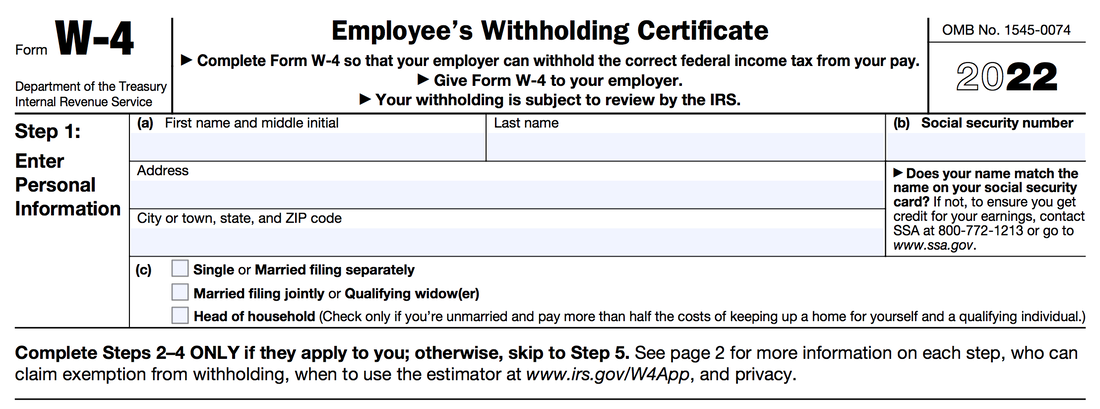

Withholding is the method used for those who are paid as an employee or who might receive pension payments, social security, and bonuses, to name a few. You typically elect how much you want to be withheld by completing a Form W4.. No matter how your withholding is taken from your salary during the year, it is deemed by the IRS as being paid in evenly.

Quarterly estimated payments is the method used by people who do not work as employees but are self-employed. It is also used for individuals who non-wage income subject to tax, including dividends, interest, capital gains, rents or royalties and have no option to withhold. Also, many retired taxpayers submit quarterly estimated payments.

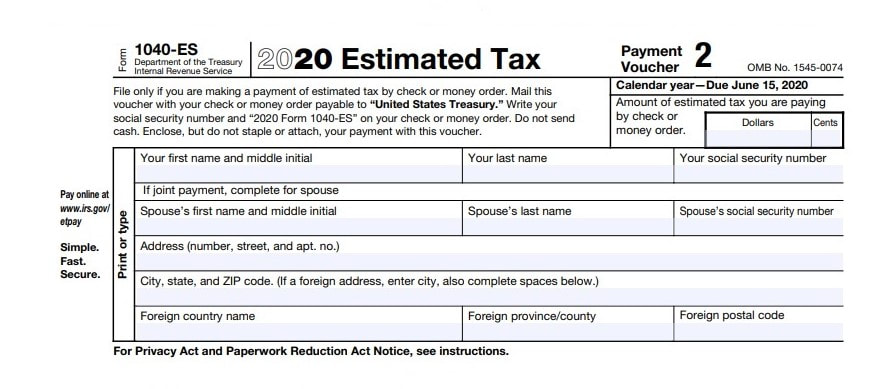

Estimated payments must be made timely--four times per year. The typical deadlines are April 15, June 15, September 15 and January 15. This quarterly system is designed to enable persons who don't have withholding comply with the "pay as you go" system. Note that these dates can vary in certain years if the date(s) fall on a holiday. Also, quarterly estimated payments for federal tax need to include the federal taxes, as well as the self-employment taxes.

- Withholding through your employer

- Submitting quarterly estimated taxes

Withholding is the method used for those who are paid as an employee or who might receive pension payments, social security, and bonuses, to name a few. You typically elect how much you want to be withheld by completing a Form W4.. No matter how your withholding is taken from your salary during the year, it is deemed by the IRS as being paid in evenly.

Quarterly estimated payments is the method used by people who do not work as employees but are self-employed. It is also used for individuals who non-wage income subject to tax, including dividends, interest, capital gains, rents or royalties and have no option to withhold. Also, many retired taxpayers submit quarterly estimated payments.

Estimated payments must be made timely--four times per year. The typical deadlines are April 15, June 15, September 15 and January 15. This quarterly system is designed to enable persons who don't have withholding comply with the "pay as you go" system. Note that these dates can vary in certain years if the date(s) fall on a holiday. Also, quarterly estimated payments for federal tax need to include the federal taxes, as well as the self-employment taxes.

How Much Do I Need to Estimate or Withhold?

To avoid federal interest and penalties you must withhold, or make estimated payments ratably, to meet 100/110% of your prior year total tax, or 90% of the actual or current year tax due, whichever is less.

If you had a zero tax liability for the prior year, you do not have to make estimated tax payments. You can wait to pay your taxes when you file your personal return. You can elect to be exempt from withholding if for the prior tax year you had no tax liability and for the current year you expect to have no tax liability.

To avoid federal interest and penalties you must withhold, or make estimated payments ratably, to meet 100/110% of your prior year total tax, or 90% of the actual or current year tax due, whichever is less.

- The 100% of prior year tax is for those taxpayers whose AGI was less than $150,000 married filing jointly or $75,000 for single filers.

- If your income is more than $150,000, you must meet 110% of your prior year tax liability.

- If you have a state income tax, most states conform to these guidelines.

If you had a zero tax liability for the prior year, you do not have to make estimated tax payments. You can wait to pay your taxes when you file your personal return. You can elect to be exempt from withholding if for the prior tax year you had no tax liability and for the current year you expect to have no tax liability.

If I'm currently paying taxes through withholding, do I need to make estimated tax payments?

Possibly. Some examples are: selling a piece of property for a gain, and selling marketable securities sold at a gain. If any of these scenarios occur, and your withholding rate is based on your wage income, you might be underpaid and owe tax.

You first need to determine the additional taxes you owe (see below for two methods) and either increase your withholding for the remainder of the year or make a tax estimate for the quarter in which you incurred the gain.

How do I make an estimated tax payment?

Generally, if you are self-employed, we will provide you with vouchers to submit estimated taxes. The estimated tax payment amount is based on your prior year income. You can mail your payment to the address shown on the voucher, or you can pay online directly at irs.gov/payments.

If you have other taxable income events, such as capital gains from the disposition of stocks and securities, you might want to make an estimated tax payment. Because investments earnings generally vary greatly each year, tax preparer professionals don't automatically create estimated payment vouchers for these types of events. Instead, there's two options when you anticipate a capital gain event:

What else should I know?

The United States arguably has the most complicated tax system in the world. Therefore, it's important to know that numerous events can cause you to owe additional taxes.

As tax preparers, we can't change history and undo what was already done. So the key is to keep in touch with your tax professional! If you are either planning or anticipate a taxable event, send us a message. We can advise you if the event will have a tax ramification. We can also possibly give you a very rough order of magnitude idea of the potential impact. If you want to get a more solid understanding of the impact and the tax liability, a tax projection engagement will be necessary.

Possibly. Some examples are: selling a piece of property for a gain, and selling marketable securities sold at a gain. If any of these scenarios occur, and your withholding rate is based on your wage income, you might be underpaid and owe tax.

You first need to determine the additional taxes you owe (see below for two methods) and either increase your withholding for the remainder of the year or make a tax estimate for the quarter in which you incurred the gain.

How do I make an estimated tax payment?

Generally, if you are self-employed, we will provide you with vouchers to submit estimated taxes. The estimated tax payment amount is based on your prior year income. You can mail your payment to the address shown on the voucher, or you can pay online directly at irs.gov/payments.

If you have other taxable income events, such as capital gains from the disposition of stocks and securities, you might want to make an estimated tax payment. Because investments earnings generally vary greatly each year, tax preparer professionals don't automatically create estimated payment vouchers for these types of events. Instead, there's two options when you anticipate a capital gain event:

- The simplest (and most basic) method is to take your average tax rate and multiply it times the capital gain event, and make a payment to "Uncle Sam" (AKA IRS). You can submit a tax payment any time during the tax year. Just keep in mind that due dates for quarterly payments (see section above). If you overpaid, you can claim the amount you are overpaid on your tax return and get a refund.

- If you want to get a more solid estimate of your tax liability, you can have us prepare a tax projection. Due to the work entailed, this is a separate billable engagement. We can let you know up front how much time we expect the projection will take us.

What else should I know?

The United States arguably has the most complicated tax system in the world. Therefore, it's important to know that numerous events can cause you to owe additional taxes.

As tax preparers, we can't change history and undo what was already done. So the key is to keep in touch with your tax professional! If you are either planning or anticipate a taxable event, send us a message. We can advise you if the event will have a tax ramification. We can also possibly give you a very rough order of magnitude idea of the potential impact. If you want to get a more solid understanding of the impact and the tax liability, a tax projection engagement will be necessary.