Retrieve Your Advance Child Tax Credit Payment Amount

If you received one or more advance Child Tax Credit payments during 2021, we need to report the total $ amount you received on your tax return. There's two ways you can find out the official amount.

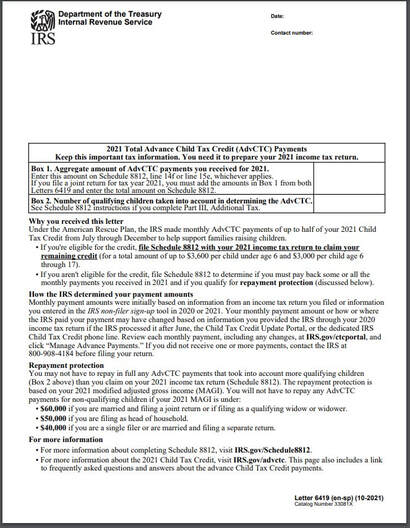

Option A: Provide us a copy of IRS letter(s) #6419:

Earlier this year, the IRS started mailing out letter #6419. If you are married, separate letters were mailed to each spouse. The letters appear to be duplicates at first glance, but they are not! We will need both letters. A sample of this letter is shown here.

Option B: Lookup the amount on your IRS taxpayer account:

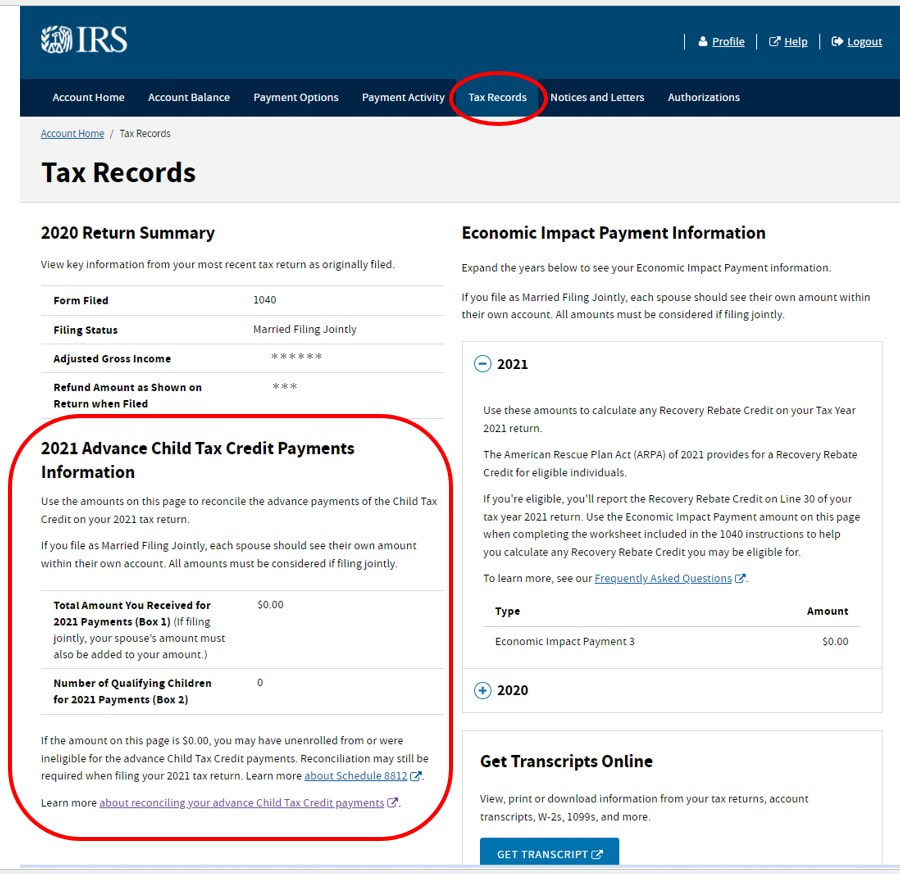

If you misplaced the letters, or did not get them in the mail, the IRS has created a portal to lookup the amount you were paid. Go to the following website:

https://www.irs.gov/credits-deductions/advance-child-tax-credit-payments-in-2021 (Opens a new window on your browser)

You will need to create an account if you do not already have an IRS account. After logging in, navigate to “View Tax Records.” The amount will be shown under the section heading “2021 Advance Child Tax Credit Payments Information.” Below is a picture of what this page looks like. Please print this screen and save it as a PDF (tip: Apple and Microsoft operating systems have a PDF printer pre-installed. When you click print, select the printer named "Print to PDF" from the drop-down menu.

Option A: Provide us a copy of IRS letter(s) #6419:

Earlier this year, the IRS started mailing out letter #6419. If you are married, separate letters were mailed to each spouse. The letters appear to be duplicates at first glance, but they are not! We will need both letters. A sample of this letter is shown here.

Option B: Lookup the amount on your IRS taxpayer account:

If you misplaced the letters, or did not get them in the mail, the IRS has created a portal to lookup the amount you were paid. Go to the following website:

https://www.irs.gov/credits-deductions/advance-child-tax-credit-payments-in-2021 (Opens a new window on your browser)

You will need to create an account if you do not already have an IRS account. After logging in, navigate to “View Tax Records.” The amount will be shown under the section heading “2021 Advance Child Tax Credit Payments Information.” Below is a picture of what this page looks like. Please print this screen and save it as a PDF (tip: Apple and Microsoft operating systems have a PDF printer pre-installed. When you click print, select the printer named "Print to PDF" from the drop-down menu.